Home

Crypto News

Market

Glassnode Identifies Next Major Bitcoin Support if BTC Loses $96K

Glassnode Identifies Next Major Bitcoin Support if BTC Loses $96K

February 17, 2025

Bitcoin. Image Owned By The Crypto Basic. Logo Displayed In The Image Are Owned By Respective Crypto Project

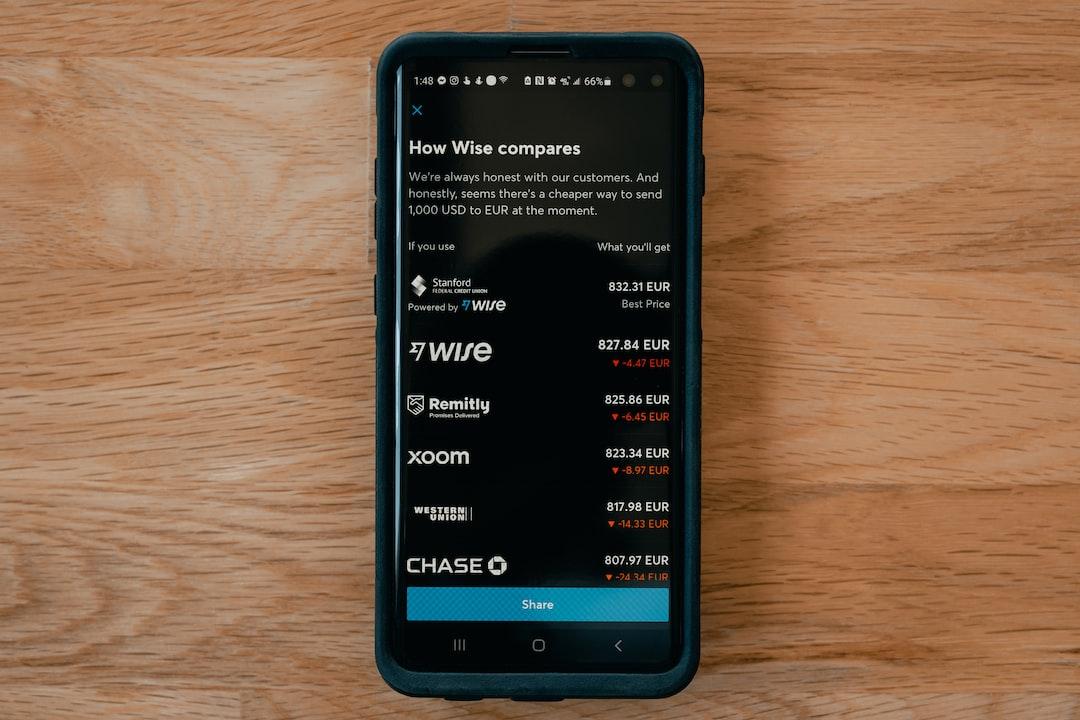

Market analytics firm Glassnode has identified the next major Bitcoin support level to watch if the bulls lose the current region. The Glassnode report comes as Bitcoin continues to trade within a critical range, with its price hovering near $96,788. Specifically, the analytics resource emphasized that if Bitcoin loses its grip on $96K, the next major support could be much lower, as there is minimal resilience.

Key Bitcoin Support Levels at $80.1K and $71K

In the report, Glassnode called attention to Bitcoin’s adjusted MVRV Z-Score, an indicator that helps traders gauge price support zones.

#Bitcoin’s adjusted MVRV Z-Score can be used to approximate areas of critical price support. So far price has held near the mean level of $96.3K. If prices break lower, the next major line of defense for bulls may be found at -1.5σ level ($80.1K): https://t.co/jwSxMmYW4ipic.twitter.com/fXLOrWjhw1

— glassnode (@glassnode)February 17, 2025

The firm noted that Bitcoin has been holding near its mean level of $96.3K, which marks a major threshold for market stability. According to Glassnode, if the price declines further, bulls might find the next major support at the -1.5 standard deviation (σ) level of $80.1K. For context, the last time Bitcoin saw the $80,000 region was in mid-November 2024, during the Donald Trump-led market-wide uptrend. Ever since the asset transcended this area, it has held above it, demonstrating resilience during the push to $89,164 in January 2025. However, Glassnode analysts believe BTC could revisit the $80K level if the current $96K support gives way. In addition, the firm called attention to Short-term holders (STHs). Specifically, the cost basis for this group sits at $92.2K, marking an important level for maintaining the current uptrend.

Bitcoin Short-Term On-chain Cost Basis | Glassnode

Additionally, the ±1σ bands, ranging between $71K and $131K, represent typical price boundaries. With Bitcoin still trading within this level, bulls maintain some control, but ongoing price action is testing their resilience. Further, major concern arises from the URPD volume profile, which indicates a liquidity gap below the current support, according to Glassnode’s analysis. Few transactions have occurred in this range, suggesting that price movement into this zone could accelerate downward pressure. The -1σ level for STH cost basis, positioned at $71K, sits at the top of this liquidity void, making it a crucial region should Bitcoin’s price dip further.

Entity-Adjusted URPD | Glassnode

Bitcoin Stuck Between Demand and Supply Walls

Meanwhile, market analyst Ali Martinez recently pointed out that Bitcoin is currently stuck between strong demand and supply zones. A demand wall exists between $94,660 and $97,540, where market participants purchased about 1.43 million BTC.

#Bitcoin is trapped between key levels, with a 1.43 million #BTC demand wall between $94,660 and $97,540, and a 1.16 million $BTC supply wall between $97,650 and $99,470. A breakout in either direction could set the trend! pic.twitter.com/zHZpDuFLBx

— Ali (@ali_charts)February 15, 2025

Meanwhile, he confirmed that a supply wall between $97,650 and $99,470 accounts for about 1.16 million BTC. According to Martinez, a breakout in either direction could set the market trend. In a previous analysis, Martinez had highlighted a resistance level at $97,530, which BTC has broken and seeks to flip to support. Below $92,110, he said support is weak, with a significant gap stretching from $90K to $70K. This confirms Glassnode’s warning that a failure to hold current levels could lead to deeper price corrections.

Demand Remains Strong

Despite the range-bound movements, on-chain analyst Darkfost noted that Bitcoin demand remains strong. He points to the 30-day moving average (DMA) of the exchange inflow/outflow ratio as a bullish indicator. When this ratio falls below 1, it suggests that more Bitcoin is leaving exchanges than entering, often a sign of accumulation. Despite Bitcoin fluctuating within the $90K–$105K range, the continued outflows show strong demand.

Bitcoin Exchange Inflow|Outflow | CryptoQuant

Notably, such trends historically have preceded short-term price increases. However, Darkfost cautions that some of these outflows could come from routine exchange transfers to institutional or custodial wallets.

Tags

Bitcoin Price Prediction

Latest Bitcoin (BTC) News Today